Depending on Social Security?

Future benefits may not be there in full for program beneficiaries

If you’ve ever read the fine print on your annual Social Security statement, you’ll see it written in black and white: “Social Security benefits are not intended to be your only source of income when you retire.” But here’s the real clincher: “The law governing benefit amounts may change because, by 2034, the payroll taxes collected will only be enough to pay about 79% of scheduled benefits.”That doesn’t mean the program is expected to run out of money, though. It only means that, unless Congress acts, the program will not be able to generate enough revenue to cover the costs of the program.1 That said, given the risk that Social Security could run short of money within a couple of decades, you should plan for the possibility, however remote, of reduced benefits.

Why benefits may fall short: slower growth, aging population

- In 2018, Social Security’s cost exceeded its income for the first time since 1982, partly due to lower projections for economic and labor-force growth, forcing the program to dip into its $3 trillion trust fund to cover benefits.2

- The 83-year-old program’s costs are rising because America’s population is aging, and revenue growth is slowing because the economy isn’t growing as fast.

Does that mean you’ll get no Social Security benefits, or reduced benefits? There’s no way to know for certain how the government will address the issue (Congress has debated how to shore up the program’s finances but has not yet agreed on what to do).

Don’t ignore the “What if’s”

If you’re a younger saver, you may need to change your spending, saving and investing strategies to make up for lost guaranteed income.

Penny wise?

President Franklin D. Roosevelt signed the Social Security Act into law on August 14, 1937, a law which he said “will give some measure of protection to the average citizen and to his family against the loss of a job and against poverty-ridden old age.” In January 1937, Ernest Ackerman was the first person to collect Social Security benefits. He received a one-time payment of 17 cents.3

Good Window of Opportunity for Roth IRA Conversions

The Roth IRA is a powerful tax-favored retirement option since it can offer a hedge against future tax-rate increases. But beyond tax planning considerations, Roth IRAs have several important advantages over traditional IRAs:

- Unlike a traditional IRA, a Roth IRA distribution is tax-free if you’ve had the account open at least five years, and reached the age of 59½, become disabled or died.

- You can make contributions to your Roth IRA after age 70½, depending on whether you fall within the earned income limits.

- Roth IRAs are not subject to the traditional IRA rules for required minimum distributions at age 70½.

The Internal Revenue Code allows IRA owners to convert significant sums from traditional IRAs to Roth IRAs. But you

have to follow these important rules (among others):

- The ability to contribute tails off at higher incomes. For 2019, the eligibility to make annual Roth IRA contributions is phased out between modified adjusted gross income (MAGI) levels of $122,000 to $137,000 (unmarried individuals) and $193,000 to $203,000 (married joint filers).4

- The conversion is treated as a taxable distribution from your traditional IRA. Doing a conversion likely will trigger a bigger federal income tax bill and possibly a larger state income tax bill. However, today’s lower federal income tax rates might be the lowest you’ll see in your lifetime, and the tax benefits of avoiding higher taxes in future years may extend to family members after death.

Many tax experts suggest that the best reason to convert some or all of your traditional IRA to a Roth IRA is if you believe your tax rate during retirement will be the same or higher than what you are paying currently. Since you’re no longer allowed to reverse a Roth IRA conversion, it’s important to understand the tax ramifications. Talk to your tax advisor before taking any action.

TRADITIONAL VS. ROTH IRA: HIGH-LEVEL COMPARISON

Here is a simplified comparison of IRA rules and tax benefits. Remember, tax laws are complex and subject to change. Consult a tax advisor about your individual situation before taking action.| Traditional IRA | Roth IRA | |

| Age limits for contributing | You must be under 70½ to contribute. | You can contribute to a Roth IRA at any age. |

| Income limits for contributions | Your contributions can’t exceed the amount of income you earned in that year or other IRS-imposed limits. | Your contributions can’t exceed the amount of income you earned in that year or other IRS-imposed limits, and can be reduced or eliminated based on your modified adjusted gross income. |

| 2019 tax-year contribution limits | If you are under age 50, you can contribute up to $6,000. If you are older than age 50, you can contribute $7,000. (Limits can be lower based on your income.). | If you are under age 50, you can contribute up to $6,000. If you are older than age 50, you can contribute $7,000. (Limits can be lower based on your income.) |

| Claiming deductions on tax return | You may be able to claim all or some of your contributions. | You cannot deduct your Roth IRA contribution. |

Balancing Act: Income, Expenses and Withdrawals

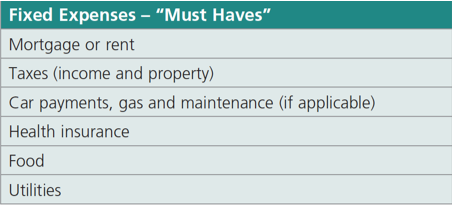

In projecting what you’ll need to save in order to generate enough retirement income, it helps to (1) prepare a realistic household budget and (2) understand what types of expenses you’ll have once you stop earning a regular paycheck.TYPES OF EXPENSES:

How much should you take out of your savings?5

Much research has focused on what percentage of account value retirees can take each year so that the money won’t run out — assuming various rates of inflation. Some analysts suggest that 3.0% to 4.0% is a sustainable withdrawal-rate range in the early years of your retirement. A 4% withdrawal rate is considered sustainable except in cases where inflation creeps above 5%. But withdrawal rates of 5% or higher are risky, especially when inflation approaches 4%.6 Depending on the size and health of your nest egg and the growth rate of your expenses, you may be able to adjust this rate in future years.

Order of withdrawals can make a difference

Not everyone agrees with this strategy, though. Depending on your circumstances, some think it makes sense to withdraw money from your IRA and 401(k) before spending down your taxable assets. “The idea is to let the assets that will be taxed at the lowest rate accumulate for the longest time,” says Robert Carlson, author of The New Rules of Retirement: Strategies for a Secure Future. For example, if you think income tax rates will be higher in the future, you may want to spend down your taxable assets sooner. Consider enlisting the assistance of online tools or retaining a financial planner to tailor the order of withdrawals to your specific needs and tax situation.

Retirement in Motion

TIPS AND RESOURCES THAT EVERYONE CAN USE

First-time Home Buyers Rely More on Family for Mortgage Help

The way that people are financing their first home purchase is changing. More than 26% of mortgage borrowers who used FHA-insured loans received help from a relative to make the down payment, according to 2018 FHA data reported by the Wall Street Journal. That number is up from 22% in 2011. Rising home prices and interest rates made it difficult for buyers to save enough for down payments — not to mention generally higher debt loads from college loans.7 Further adding to borrower stress is the fact that the gap between owning and renting continues to widen, according to Freddie Mac.8

Q&A

How can I include funds that consider ESG in

my portfolio?

The companies you choose to invest in can matter to you

just as much as the financial results. Many 401(k) plans offer funds that incorporate environmental, social and governance (ESG) criteria as well as financial fundamentals in their investment process. Studies show that a growing number of investment managers consider ESG factors when selecting companies for investment. To learn how to incorporate more ESG exposure into your portfolio, talk to your plan administrator or HR department.

Quarterly Reminder

With changes in the new tax law, you may have decided to lower your federal tax withholding so that you’re taking home more pay. It may be very tempting to use a fatter wallet to buy more things. But if you are falling short of your retirement goals, consider increasing your 401(k) contribution instead.Tools & Techniques

Investment concepts you should understand

Fraud is a rapidly growing risk for all Americans, not just the elderly. The AARP Fraud Watch Network has useful tips to avoid credit card scams, get scam alerts delivered to your phone and offers a scam-tracking map to see (and report) what’s been perpetrated in your local area — and much, much more: https://www.aarp.org/money/scams-fraud/.

Corner on the Market

Basic financial terms to know

INFLATION

Inflation measures the rate at which the average price level of a basket of selected goods and services in the economy rises over a period of time. When prices rise, money loses value. That’s why it’s important that your investments keep pace with inflation — so that you don’t lose purchasing power.

2 Ibid.

3 Jessica Kwong, “Social Security Anniversary: Why, 83 Years Later, the Safety-Net Program is Running Out of Money,” Newsweek, Aug. 14, 2018. https://www.newsweek.com/social-security-anniversary-why-its-running-out-1071112

4 Source: Bill Bischoff, “How the new tax law created a ‘perfect storm’ for Roth IRA conversions in 2019,” MarketWatch.com, Jan. 16, 2019. https://www.marketwatch.com/story/how-the-new-tax-law-creates-a-perfect-storm-for-roth-ira-conversions-2018-03-26

5 Withdrawals from qualified plans prior to age 59½ may be subject to a 10% IRS penalty. Account values are subject to income tax upon distribution. This discussion is not intended to show the performance of any fund for any period of time or fluctuations in principal value or investment return. Periodic investment plans do not ensure a profit nor protect against loss in declining markets.

6 Gerstein Fisher, “What’s a Sustainable Withdrawal Rate for a Retirement Portfolio?” Seekingalpha.com, May 1, 2018. https://seekingalpha.com/article/4168085-sustainable-withdrawal-rate-retirement-portfolio

7 Source: “More First-Time Home Buyers Are Turning to the Bank of Mom and Dad,” Wall Street Journal, Jan. 4, 2019. https://www.wsj.com/articles/more-first-time-home-buyers-are-turning-to-the-bank-of-mom-and-dad-11546597800?cx_testId=16&cx_testVariant=cx&cx_artPos=3&cx_tag=collabctx&cx_navSource=newsReel#cxrecs_s

8 Freddie Mac Multifamily Research Center, 2019 Outlook, Jan. 2019. http://www.freddiemac.com/research/pdf/2019-Outlook.pdf

3rd Qtr 2019

3rd Qtr 2019